Getting The Paypal Business Loan To Work

Wiki Article

A Biased View of Paypal Business Loan

Table of ContentsAbout Paypal Business LoanAll About Paypal Business LoanMore About Paypal Business LoanPaypal Business Loan for DummiesSee This Report about Paypal Business Loan

You'll have numerous choices when checking out start-up car loans, including SBA car loans, equipment financing, lines of credit score, short-term lendings, as well as business credit score cards. The settlements will be based upon the quantity of the lending, as well as the rate of interest rate, term, and collateral. To qualify, it's usually required to have a credit rating of 680 or higher.With a company acquisition finance, you'll get anywhere from $5,000 to $5,000,000. The terms can be revolving or for 10-25 years. The funds will not get here specifically quickly, usually taking concerning a month to strike your account. Among the ideal elements of these finances is that rates of interest start as low as 5 (PayPal Business Loan).

These desirable prices mean you'll conserve a substantial quantity of money over the life time of the lending. Getting an organization acquisition funding can provide a jumpstart to your service, as acquiring a franchise or existing business is a terrific way to tip right into a practical organization without the gruelling work of constructing it from scratch.

While the application varies depending on whether you're getting a franchise business or existing service, you can plan on lenders assessing elements such as your credit report, organization tenure, as well as earnings. You'll need to provide documents of the company's performance as well as assessment, in addition to your own company strategy and also economic forecasts.

The 7-Minute Rule for Paypal Business Loan

There's no worry with your organization lugging financial debt. The inquiry is whether your organization can handle its financial debt commitments. To obtain a bead on your organization financial obligation insurance coverage, a loan provider evaluate your capital and also debt payments. If you're bring personal financial obligation, you're in good firm. Regarding 80% of Americans have some form of financial obligation.

To obtain this statistics, a loan provider will certainly separate your arrearage by the collective quantity of your available revolving credit scores. Lenders likewise appreciate the state of your business debt (PayPal Business Loan). Having debt isn't a huge offer. What matters is whether the quantity of financial debt you're lugging is proper contrasted to the size of your service and also the market you're working in.

5 Easy Facts About Paypal Business Loan Explained

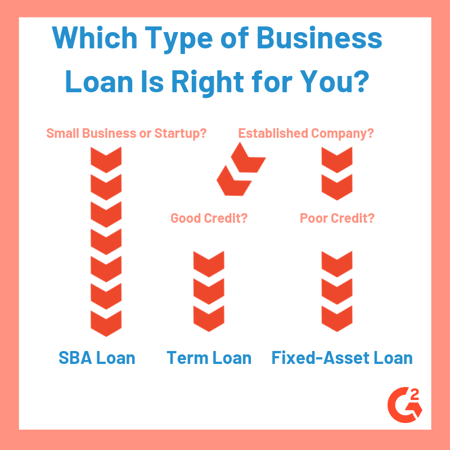

Lenders are more motivated to deal with you if your company is trending in the best instructions, so they'll want to identify what your standard income development will be over time. If yours lands at or above the average for your sector, you're in wonderful shape. If you fall below the average, intend on there being some possible difficulties in your search of funding.There are lots of various sorts of small-business financings whatever from a business line of credit rating to billing factoring to seller cash loan each with its own advantages and disadvantages. The ideal one for your organization will certainly depend on when you require the cash visit this web-site and also what you require it for. Below are the 10 most-popular sorts of service fundings.

Best for: Services looking to broaden. The Small Organization Administration ensures these finances, which are provided by banks and also other lending institutions.

Rates will certainly depend on the value of the tools and also the strength of your service. You can obtain affordable prices if you have strong credit and also company financial resources.

The 6-Second Trick For Paypal Business Loan

Various other services may be provided, such as consulting as well as training. Cons: Smaller car loan amounts. You might have to meet stringent eligibility requirements. Best for: Start-ups as well as services in deprived communities. Companies seeking only a redirected here little quantity of financing.As we have actually gone over, there are lots of different sorts of service loansand the best one for your business ultimately comes down to a number of variables. At the end of the day, each kind of bank loan is made for a different company need. Therefore, you'll need to consider your credit scores, your company's funds, the size of time you've been operating, and also your factor for the loan prior to limiting your alternatives.

You'll likewise discover numerous options that you can make use of if a tiny organization car loan is not your best funding choice. There are specific things that every local business proprietor ought to understand prior to heading down the application procedure. Right here are the 5 main facts to recognize: They're all various.

Getting The Paypal Business Loan To Work

There are a great deal of scams. Know your financial advice obligation solution insurance coverage ratio. Be all set to back your service. Let's get going: Bank loan are as varied as the local business owners that use for them. Not every lender operates in the very same way, as well as also within the same lending business, you'll find numerous kinds of loans.Report this wiki page